LiteFinance Malaysia

LiteFinance Malaysia Review

Since 2005, LiteFinance forex (formerly LiteForex), an online ECN broker, has been offering its clients access to Tier 1 liquidity in the currency, commodity, and stock market. Clients can trade all major currency pairs and cross rates, oil, precious metals, stock indexes, blue chips, and an extensive range of cryptocurrency pairs at LiteFinance (formerly LiteForex). In this LiteFinance review in Malaysia, we will learn about the broker’s features, advantages, and what it offers to Malaysian traders.

LiteFinance is a widely recognized forex broker in Malaysia known for providing top-notch trading services to its clients. It has gained popularity for its user-friendly trading platforms, competitive spreads, and a wide range of trading instruments. LiteFinance offers a variety of account types catering to both beginners and experienced traders. The company also provides educational resources, including webinars, tutorials, and articles to help traders improve their skills and understand market trends. The customer support is commendable as they are easily accessible and provide prompt responses. However, it is always important for traders to do their research before investing, as trading involves risks.

LiteFinance Account Types

ECN Account

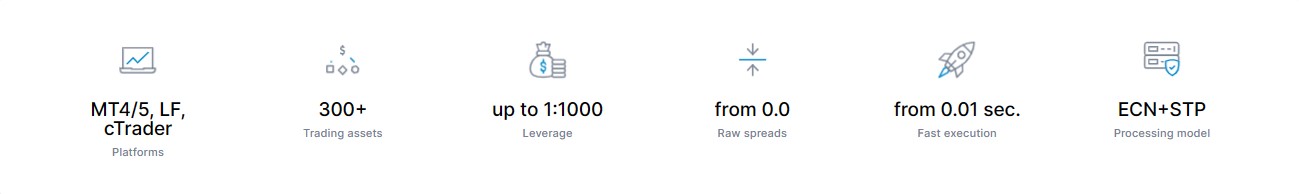

ECN (Electronic Communications Networks) Account offers several key advantages for traders. It provides increased quoting precision and adopts a market execution approach, eliminating the problem of requotes. There are no restrictions on Stop & Limit levels, which provides traders with more flexibility in managing their trades. The platform also supports scalping and news trading, with no limits on the duration of transactions. All trades are directly delivered to liquidity providers, which ensures transparency and reduces the chances of conflicts of interest. Additionally, a social trading platform is available for traders to share and learn strategies from each other. The account offers a high leverage of 1:1000, enabling traders to maximize their trading potential. Furthermore, it has a low barrier to entry, with a minimum deposit requirement of just $50.

Classic Account

Offers increased quoting precision, allowing for more accurate pricing and better trades. It operates on a market execution basis, meaning trades are executed at the best available price with no requotes. There are also no stop and limit levels, providing traders with more freedom and flexibility. With leverage of up to 1:1000, traders can maximize their trading positions. The platform supports a wide range of trading platforms, including MT4/MT5, providing a versatile trading environment. Moreover, it is accessible with a minimum deposit of just $50, making it a convenient option for both beginner and experienced traders.

Cent Account

A Cent Forex account serves as the optimal gateway into the realm of authentic trading, allowing you to earn your initial profit. This account type is designed for beginners in Forex trading, offering a deeper comprehension of trading psychology. Simultaneously, Cent accounts reduce trading risks as deposits are measured in cents. The minimum deposit required for this account type is $10.

Swap-Free Account

Swap-free accounts, also known as Islamic accounts, are designed for traders who cannot earn or pay interest due to their religious beliefs. This type of account complies with the Sharia law, which prohibits the giving or receiving of interest. All the other trading conditions and terms are the same as the regular trading accounts.

FREE Demo Account

The LiteFinance Demo Account in Malaysia is an excellent trading tool designed for beginners and experienced traders alike. This account provides users with a simulated trading environment, allowing them to practice trading strategies, understand market trends, and learn the basics of Forex trading without risking any real money. It offers a realistic representation of live trading conditions, including real-time market prices and trading tools. The LiteFinance Demo Account is not only beneficial for gaining practical trading experience but also for testing and refining trading strategies. It is an invaluable resource for Malaysian traders who want to enhance their trading skills before venturing into the live markets.

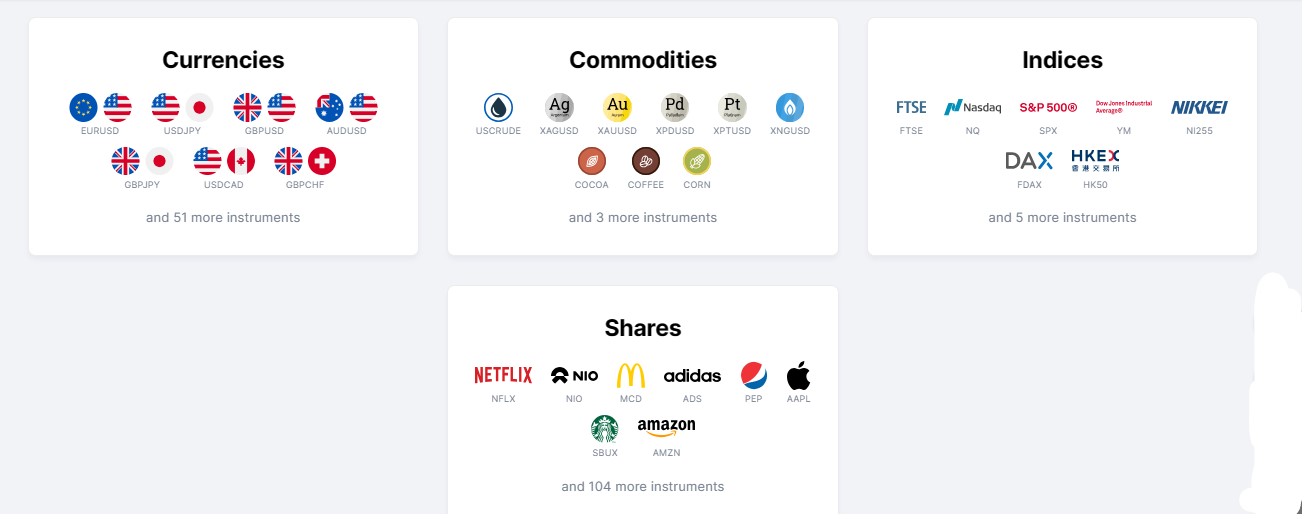

Trading Assets

LiteFinance Malaysia offers a wide range of trading assets to meet the diverse needs and preferences of their clients.

- Currency: This refers to trading in the forex (foreign exchange) market. LiteFinance provides its users the opportunity to trade various currency pairs, including major, minor and exotic pairs.

- Commodities: Commodities trading involves buying and selling physical goods like gold, silver, oil, and agricultural products. LiteFinance provides an environment to trade various commodities, offering opportunities for diversification and hedging strategies.

- Global Stock Indexes: This involves trading on the overall performance of a stock market index. The index could be based on a particular region or a global index. This allows traders to invest in the performance of whole sectors or economies.

- CFD NYSE: Contract for Difference (CFD) allows traders to speculate on the rising or falling prices of fast-moving global financial markets. CFD NYSE refers to these contracts in the New York Stock Exchange, the largest stock exchange by market capitalization.

- CFD NASDAQ: Similar to CFD NYSE, CFD NASDAQ refers to contracts on the NASDAQ exchange, which is home to many tech and growth companies.

- CFD EURONEXT: This refers to CFDs on the Euronext exchange, the largest stock exchange in Europe. This allows traders to speculate on the performance of major European corporations.

- CFD London LSE: This refers to trading CFDs on the London Stock Exchange (LSE), one of the world’s oldest stock exchanges. LSE is home to some of the largest multinational companies.

- CFD XETRA: CFD XETRA refers to trading on the XETRA exchange, an all-electronic trading system based in Frankfurt, Germany. It is known for its efficiency and transparency.

In essence, LiteFinance offers a broad range of trading assets, catering to both beginner and experienced traders. It provides opportunities to trade on different markets, offering greater portfolio diversification.

LiteFinance Trading Platforms in Malaysia

LiteFinance MT4 (MetaTrader 4)

MetaTrader 4, a widely-used platform for Forex trading and analysis, enables trading in currencies, shares, precious metals, and CFD on stock indices. LiteFinance Malaysia’s clients have the option to download the MetaTrader 4 trading platform, along with its mobile applications designed for PDA, iPhone®, iPad ™, and Android devices. It provides traders with access to advanced trading operations in a fast, secure, and reliable environment.

LiteFinance MT5 (MetaTrader 5)

The LiteFinance MT5 platform is an updated version of the well-liked forex trading platform, MetaTrader 4. It boasts enhanced features and a broader range of tools. This advanced, high-tech trading platform can be installed on a desktop computer, and it also has a mobile application available for iPhone® and Android. It is compatible with both CENT and CLASSIC accounts.

cTrader

cTrader, a well-known trading platform, is favored for Forex and CFDs trading. With an array of features including a user-friendly interface, advanced chart drawing tools, swift execution, level II Market Depth, Autochartist, and extensive algorithmic trading options, it offers a robust trading experience. The platform can be downloaded for use on PC, as a web version, or on iOS and Android devices.

Mobile App

LiteFinance provides customers with free Mobile Forex apps. These applications, which offer daily analysis, trading signals, and strategies, can be downloaded and installed on your tablet or smartphone. They cater Android and iOS devices, offering mobile Forex applications. The applications are multilingual, supporting more than 8 languages and are regularly updated. Enjoy 24/7 analytical reviews, signals, and a plethora of trading strategies by installing LiteFinance’s mobile apps.

Trading Tools

LiteFinance offers a wide range of trading tools for Malaysian traders to enhance their trading experience and make informed decisions. These tools include:

- Economic Calendar: It is an essential tool for traders as it provides them with real-time updates on significant economic events that can impact the forex and other financial markets. It helps traders to stay ahead of the market trends and make anticipatory moves.

- Analytics: LiteFinance provides in-depth analysis of the markets, including forex, commodities, indices, and stocks. This helps traders to understand the market trends and make informed trading decisions.

- Analytical Materials from Claws & Horns: These are expert forecasts, technical and fundamental analysis reports, and trading signals from Claws & Horns, a leading independent analytical service provider. These materials can help traders to gain insights into the market trends and dynamics.

- Trader’s Calculator: This tool allows traders to calculate and plan their trades effectively. It can help them to determine the potential profit or loss from a trade, considering the trading instrument, lot size, leverage, and other factors.

- Fibonacci Calculator: The Fibonacci Calculator is a useful tool for technical traders. It helps them to identify potential support and resistance levels based on the Fibonacci retracement and extension levels.

- Currency Rates: LiteFinance provides real-time updates on currency exchange rates. This helps forex traders to monitor the currency pairs they are interested in and make timely trading decisions.

- Economics News: Staying updated with the latest economic news is crucial for successful trading. LiteFinance provides regular updates on global economic news, including monetary policy decisions, economic indicators, and geopolitical events. This can help traders to understand the market sentiment and make informed trading decisions.

LiteFinance Deposit Options in Malaysia

- Bank cards – You can deposit funds into your trading account using bank cards such as Visa/Mastercard through the CardPay processing center. The LiteFinance minimum deposit amount for this option is $10.

- Local Deposit – A service that allows you to deposit or withdraw money via a Lite Finance representative in your area. This efficient and convenient option is perfect for clients who may not have access to electronic payment systems or international wire transfers. It also allows you to withdraw money in your local currency. The minimum amount for this service is $1.

- Bank Wire Deposit – A minimum of $100 is necessary for this method. It offers a cost-effective way to transfer large sums of money from anywhere in the world. You’ll need to complete an online wire transfer form and receive guidance on filling out a wire transfer form, which can be acquired from your bank. Once LiteFinance receives the wire-transferred funds from your bank, they will be credited to your account.

- E-Wallets – E-Wallets are favored for their speed and convenience, allowing users to transact anytime and anywhere. Deposits on LiteFinance via E-Wallets are usually instant, providing immediate access to funds. However, processing times might differ based on the E-Wallet service. In Malaysia, PayPal, Skrill, Neteller, ecoPayz, FasaPay, and PerfectMoney are accepted E-Wallets. The minimum deposit for this option is $10.

- Perfect Money is a globally accessible and easy-to-use payment system for instant forex account top-ups. This option allows you to fund trading accounts from anywhere in the world. The minimum deposit allowable with this method is $10.

- The electronic payment system, Advanced Cash (AdvCash), enables users to swiftly deposit funds from their LiteFinance trading account. It supports a variety of payment methods such as YooMoney, QIWI, cryptocurrencies, SEPA transfers, and Visa/MasterCard bank cards in multiple currencies.

LiteFinance Withdrawal Options

- Bank Cards: LiteFinance offers the option for customers in Malaysia to withdraw funds using their bank cards. This is a reliable and secure option, and the processing time is typically within 1-3 business days.

- Local Withdrawal: This option allows customers in Malaysia to withdraw funds directly from their LiteFinance account. This method is quick and convenient, with processing times varying depending on the customer’s local bank.

- Bank Wire: Another withdrawal option offered by LiteFinance in Malaysia is bank wire. This involves transferring money from the LiteFinance account to the customer’s bank account. The processing time for this method can take anywhere from 1-5 business days, depending on the banks involved.

- Electronic Transfers: E-Wallets are preferred due to their speed and convenience, facilitating transactions at any time and place. Withdrawals through E-Wallets on LiteFinance are typically instantaneous, giving immediate access to funds. However, processing times can vary depending on the E-Wallet service. In Malaysia, accepted E-Wallets include PayPal, Skrill, Neteller, ecoPayz, FasaPay, AdvCash, and PerfectMoney.

- Cryptocurrencies: For customers in Malaysia interested in digital currency, LiteFinance allows withdrawals in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The processing time for cryptocurrency withdrawals can be instantaneous or take up to a few hours. However, it’s important to note that the transaction speed largely depends on the blockchain network’s congestion at the time of the transaction.

You can only withdraw funds to the same wallet and in the same currency that you used for depositing. This means if you deposit money into your account with Skrill, you can only withdraw money using the same Skrill wallet used for deposit.

LiteFinance Additional Features

LiteFinance is committed to providing its clients with a comprehensive trading experience, which is why, in addition to its basic services, it offers a range of additional features.

- AutoWithdrawal: This feature is designed to streamline your transaction process and save your time. With AutoWithdrawal, you no longer have to wait for your withdrawal requests to be processed manually. Once you set up this feature, your funds will be automatically transferred to your designated account as soon as they become available. AutoWithdrawal ensures faster, easier, and more efficient transactions.

- VPS (Virtual Private Server): A VPS allows you to trade 24/7, even when your computer is off. It provides a secure, private environment for your trading activities, ensuring that your trades are executed immediately and without interruptions. This feature is especially beneficial for traders using automated trading systems, as it allows them to keep their systems running non-stop, thus maximizing their trading opportunities.

- Forecasts for Quotes: This feature provides you with predictions on future price movements, based on historical data and market analysis. By using these forecasts, you can make informed decisions about your trading strategies and potentially increase your profits. These forecasts are generated by advanced algorithms and are updated regularly to reflect the latest market trends.

These additional features, coupled with LiteFinance’s robust trading platform and exceptional customer service, ensure that you have all the tools you need to succeed in the financial markets. Whether you’re a beginner or an experienced trader, LiteFinance’s additional features can help you streamline your trading activities and enhance your trading performance.

Social Trading Feature

The LiteFinance Social Trading Feature is a unique tool that allows traders to follow and copy the trading strategies of other successful traders. This feature is designed to help both novice and experienced traders to optimize their trading decisions and potentially increase their profits. It provides a platform where traders can share their trading insights, strategies, and real-time trading activities. Users can also interact with each other, ask questions, and discuss various trading strategies. It’s a great way for beginners to learn from experienced traders and for experts to share their knowledge.

Research and Education for Beginners

- LiteFinance Webinars: Lite Finance Malaysia hosts a range of webinars on various topics related to finance. These webinars are designed to educate and inform users about the latest trends, strategies, and concepts in the financial sector. They are conducted by experts in the field and often include interactive sessions where attendees can ask questions and discuss topics in detail.

- Forex Glossary: This is a comprehensive list of terms and jargon used in the Forex market. This glossary is a useful tool for both beginners and experienced traders, as it allows them to understand the complex terminology of the Forex market better.

- Forex Books: Lite Finance provides a collection of books dedicated to Forex trading. These books cover a wide range of topics, from basic concepts and strategies to more advanced techniques and approaches. They are intended to help traders of all levels increase their knowledge and improve their trading skills.

- Trading Strategies: This section includes information and tips on various trading strategies. These strategies can be used by traders to maximize their profits and minimize their risks in the financial market. The strategies are explained in a way that is easy to understand, making them accessible for both beginners and experienced traders.

- Reviews: Customers of LiteFinance offer reviews regarding the platform and its services. These reviews are intended to inform new users about the broker’s performance before they commence their investing journey.

Customer Support

LiteFinance offers comprehensive customer support for its clients in Malaysia. The customer support is available 24 hours a day, 5 days a week. This means that you can reach out to them for any queries or issues at any time from Monday to Friday. The company offers several ways for you to reach them.

- Live Chat: LiteFinance provides a live chat feature that allows you to communicate in real-time with their customer support team. This is a great option if you need quick responses to your queries.

- Email: clients@litefinance.com. This method is perfect if your query requires a detailed explanation or if you need to send them any documents.

- Skype username: liteforex.support

- Telegram: Search for LiteFinanceSupport on the app.

- Phone: +447520644437

Please note that the availability of each contact method may vary depending on the time and day. However, rest assured that LiteFinance strives to provide efficient and effective customer support to all its clients in Malaysia.

Is LiteFinance Legal in Malaysia?

LiteFinance broker is fully legal and operational in Malaysia. It adheres to the country’s financial regulations and guidelines, ensuring its services are transparent, reliable, and trustworthy. Malaysian residents can freely use LiteFinance for their financial needs and investment goals. The platform’s legality in Malaysia has significantly contributed to its growing popularity among local users, who appreciate its blend of user-friendly features and robust security measures.

Regulations

LiteFinance Global LLC, a Limited Liability Company, is registered in St. Vincent & the Grenadines under the number 931 LLC 2021. The company’s registered address is Euro House, Richmond Hill Road, Kingstown, St. Vincent and the Grenadines. You can reach them at clients@litefinance.com.

Liteforex (Europe) LTD, a Cyprus Investment Firm (CIF), is registered under the number HE230122. It operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC), with a license number 093/08, following the Markets in Financial Instruments Directive (MiFID). The company ensures that all retail client funds are protected by the Investor Compensation Fund, subject to eligibility. You can reach them at support@liteforex.eu.

LiteFinance Global LLC is not available to residents in the EEA countries, USA, Israel, Russia, Japan, and several other countries.

Is LiteFinance Halal in Malaysia?

LiteFinance is halal in Malaysia, which means it is permissible under Islamic law. It operates in compliance with the principles of Islamic finance, ensuring that its operations and services do not involve activities prohibited by Sharia law such as charging interest (Riba), uncertainty (Gharar), or investment in forbidden (Haram) industries. LiteFinance’s adherence to these principles makes it a suitable choice for Muslims in Malaysia who are seeking to engage in financial activities that align with their religious beliefs.

LiteFinance Broker Review Malaysia – Conclusion

In conclusion, LiteFinance Broker in Malaysia provides a reliable platform for traders to navigate the Forex market. It offers a range of services and tools that cater to both beginners and experienced traders. This platform is recognized for its user-friendly interface, security measures, and its commitment to providing clients with up-to-date market information. With its robust customer service, Lite Finance Malaysia ensures that clients have the necessary support to make informed trading decisions. Therefore, whether you are a novice or an experienced trader, LiteFinance Forex Malaysia is a commendable choice for your trading needs.